Some Known Details About Medicare Advantage Agent

:max_bytes(150000):strip_icc()/types-of-employee-benefits-and-perks-2060433-Final-edit-60cedb43c4014fdeb51aa3cd3c25f027.jpg)

Having wellness insurance has numerous advantages. It shields you and your family from monetary losses in the same means that home or automobile insurance coverage does. Even if you are in healthiness, you never ever know when you might have a crash or obtain unwell. A journey to the healthcare facility can be a lot more pricey than you could anticipate.

Ordinary prices for giving birth are up to $8,800, and well over $10,000 for C-section shipment. 1,2 The overall price of a hip replacement can run a monstrous $32,000. These examples sound scary, but the bright side is that, with the right strategy, you can shield on your own from many of these and other kinds of clinical bills.

With a healthiness insurance plan, you aid shield the wellness and financial future of you and your household for a life time. Medicare Advantage Agent. With the brand-new methods to get inexpensive medical insurance, it makes feeling to get covered. Various other crucial advantages of wellness insurance policy are accessibility to a network of physicians and healthcare facilities, and various other sources to assist you stay healthy

Medicare Advantage Agent Can Be Fun For Anyone

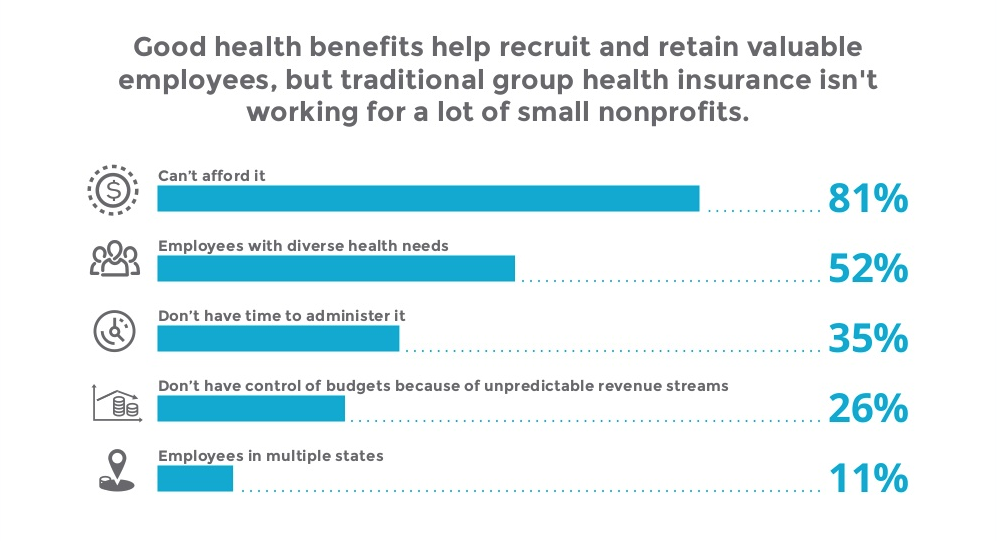

Today, roughly 90 percent of united state residents have medical insurance with substantial gains in health and wellness protection taking place over the past five years. Medical insurance helps with access to care and is linked with lower fatality prices, much better health results, and improved efficiency. In spite of current gains, greater than 28 million individuals still lack protection, placing their physical, mental, and economic health and wellness in jeopardy.

Particularly, current researches that assessed adjustments in states that expanded Medicaid contrasted to those that didn't highlight the worth of protection. Grown-up Medicaid enrollees are 5 times much more likely to have routine resources of care and four times more probable to get preventative care services than individuals without coverage.

Little Known Facts About Medicare Advantage Agent.

Individuals in Medicaid expansion states have higher prices of diabetes diagnoses than those in states that did not increase. They receive a lot more prompt, and as a result much less difficult, treatment for 5 usual surgical problems. Medicaid expansion is connected with accessibility to prompt cancer medical diagnoses and therapy.11,12,13,14,15 Protection boostsgain access toto behavior health and substance use condition treatment. By 2016, 75 %of Medicaid enrollees with OUD filled prescriptions for medication treatment. Insurance coverage lessens expense barriers to accessing care. Fewer individuals in states that expanded Medicaid record expense as a barrier to care than those in states that did not increase Medicaid, and fewer people in growth states report skipping their medicines due to expense. Hispanics have overmuch high rates of being.

uninsured, without insurance compared to contrasted whites. The high rate of uninsured places anxiety on the broader health care system. People without insurance delayed required care and count more greatly on healthcare facility emergency situation divisions, leading to limited sources being routed to deal with conditions that typically might have been stopped or taken care of in a lower-cost setting. While all carriers offer some degree of visit this site right here charity treatment, it is not enough to.

satisfy totally the requirements of the without insurance (Medicare Advantage Agent). In 2017, medical facilities supplied$ 38.4 billion in uncompensated treatment to individuals. Nevertheless, health centers likewise took in an added $76.8 billion in underpayments from Medicare and Medicaid, and are facing added funding reductions with cuts to the Medicare and Medicaid out of proportion share healthcare facility repayment programs. The Institute of Medicine(IOM )Board on the Effects of Uninsurance launches an extensive exam of proof that addresses the importance of health and wellness insurance coverage with the publication of this report. Protection Issues is the initial in a series of 6 records that will certainly be released over the next two years recording the fact and consequences of having an estimated 40 million people in the USA without health and wellness insurance coverage. The Board will take a look at whether, where, and how the wellness and economic worries of having a large uninsured populace are really felt, taking a wide point of view and a multidisciplinary technique to these questions. To a wonderful degree, the expenses and repercussions of uninsured and unstably insured populations are concealed and hard to gauge. The objective of this collection of researches is to refocus plan attention on a historical problem.

Little Known Facts About Medicare Advantage Agent.

Complying with the longest economic expansion in American background, in 1999, an approximated one out of every 6 Americans32 million adults under the age of 65 and more than 10 million childrenremains without insurance(Mills, 2000 ). This structure will lead the evaluation in doing well reports in the series and will be customized to address each record's set of subjects.

The initial action in determining and advice measuring the repercussions of being without medical insurance and of high uninsured rates at the neighborhood degree is to identify that the functions and constituencies offered by health and wellness insurance coverage are numerous and distinctive. Ten percent of the population represent 70 percent of healthcare expenses, a relationship that has stayed continuous over the previous 3 years(Berk.

and Monheit, 2001). Therefore wellness insurance coverage continues to serve the feature of spreading threat even as it increasingly funds regular care. From the perspective of healthcare carriers, insurance policy carried by their patients helps protect an earnings stream, and areas profit from monetarily feasible and steady wellness treatment practitioners and establishments. Government supplies medical insurance to populations whom the private market may not offer properly, such as impaired and elderly individuals, and populations whose accessibility to healthcare is socially valued

, such as kids and pregnant ladies. The supreme ends of medical insurance protection for the private and communities, consisting of workplace neighborhoods of staff members and employers, are improved health and wellness results and high quality of life. Without doubt, the complexity of American healthcare financing devices and the riches of resources of details include to the general public's complication and suspicion regarding health insurance data and their analysis. This record and thosethat will follow purpose to distill and provide in easily reasonable terms the substantial study that bears upon concerns of medical insurance coverage and its importance. Fifty-seven percent of Americans questioned in 1999 thought that those without wellness insurance are"able to get the treatment they need from medical professionals and healthcare facilities" (Blendon et al., 1999, p. 207). In 1993, when national focus was focused on the issues of the uninsured and on pending wellnesstreatment regulation, just 43 percent of those surveyed held this idea(Blendon et al., 1999 ). They also get fewer precautionary solutions and are much less likely to have regular look after chronic problems such as high blood pressure and diabetes mellitus. Chronic conditions can lead to expensive and disabling difficulties if they are not well taken care of(Lurie et al., 1984; Lurie et al., 1986; Ayanian et al., 2000 ). One nationwide survey asked greater than 3,400 grownups about 15 have a peek at this website highly significant or somber problems. Added evidence is offered later in this chapter in the conversation of insurance policy and access to health and wellness care. Individuals without health and wellness insurance are young and healthy and choose to go without protection. Almost fifty percent(43 percent )of those evaluated in 2000 thought that people without medical insurance are more probable to have illness than individuals with insurance coverage.